Financial

- Home / Industries /

- Financial

Business intelligence in Financial

Financial Performance Overview: My dashboard provides a clear snapshot of financial performance, including revenue, expenses, and key financial ratios.

Investment Portfolio Tracking: It helps monitor the performance of investment portfolios, including stocks, bonds, and other assets, allowing for informed investment decisions.

Budget Management: With budget tracking features, the dashboard helps individuals and businesses monitor spending against budget targets, identify areas for cost savings, and maintain financial discipline.

Cash Flow Analysis: By visualizing cash flow patterns and trends, the dashboard assists in managing liquidity, identifying potential cash flow problems, and optimizing working capital management.

Risk Assessment: The dashboard includes risk monitoring tools to identify and assess potential financial risks, such as market volatility, credit risk, and liquidity risk, enabling proactive risk management strategies.

AI in Financial

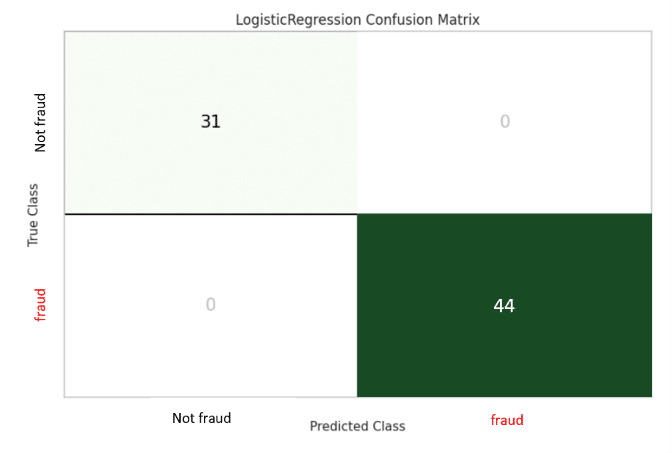

This AI application focuses on detecting fraudulent activities within financial systems. It utilizes machine learning techniques to analyze patterns, anomalies, and suspicious transactions in real-time. Fraud detection helps protect businesses and consumers from financial losses. It can quickly identify potentially fraudulent activities, allowing organizations to take immediate action and safeguard their assets.

The digram below shows how good the fraud detection model as it gets 100% accuracy. We can see here that the model predict 31 class as ( not fraud) and the actual values of those 31 is also not fraud And vise versa in the prediction (fraud) as the 44 predictions is like the true values. , which means it accuarltly predicted all the samples right.

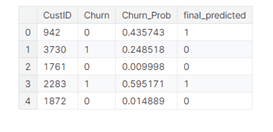

Customer churn refers to customers discontinuing their relationship with a financial institution or service provider. Predicting and reducing customer churn is crucial for financial institutions as it impacts revenue, customer base, and market share. By leveraging machine learning, financial institutions can analyze customer data and engagement patterns to identify potential churn indicators. This enables proactive retention strategies, personalized incentives, and improved customer experiences to maintain a loyal customer base and drive long-term growth.

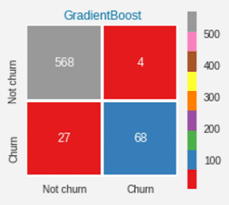

The table on the left and the diagram on the right display the model’s performance. It’s noted that from the right diagram the model correctly predicts 568 instances as non-churn and 68 instances as churn, achieving an overall accuracy of 95%. Nonetheless, there are some cases where it misclassifies the correct class with a slight error rate of 5%. In the table on the left, we observe that for cases 0 and 1, the model fails to predict them accurately, while it correctly predicts all other cases.

Optical Character Recognition (OCR) for credit cards is an AI application that enables automated extraction of information from credit cards using computer vision techniques. It involves the conversion of printed or handwritten text on credit cards into machine-readable data. OCR technology plays a crucial role in the finance sector, where credit card information needs to be accurately and efficiently processed for various purposes. It enhance operational efficiency, reduce manual errors, and improve customer experiences. By automating the extraction of credit card data, financial institutions can accelerate transaction processing, minimize data entry errors, and provide a seamless user experience.

Customer segmentation involves dividing customer base into distinct groups based on shared characteristics, behaviors, and preferences. This AI-driven approach utilizes machine learning algorithms to analyze vast amounts of customer data, including transaction history, demographics, financial goals, and risk profiles. By identifying and understanding different customer segments, financial institutions can tailor their products, services, and marketing strategies to better meet the specific needs and preferences of each segment. Customer segmentation in finance enables personalized experiences, targeted marketing campaigns, and improved customer satisfaction, ultimately leading to stronger customer relationships, increased loyalty, and enhanced business performance.

Leveraging the Full Potential of Your Cloud Investment